300

Risk analytics calculated on over 300 funds daily

€50bn

Risk reporting for clients with over €50 billion assets under management

10mn

Over 10 million instruments and securities available in the RiskSystem database

Trusted by our clients to manage their risk and regulatory reporting

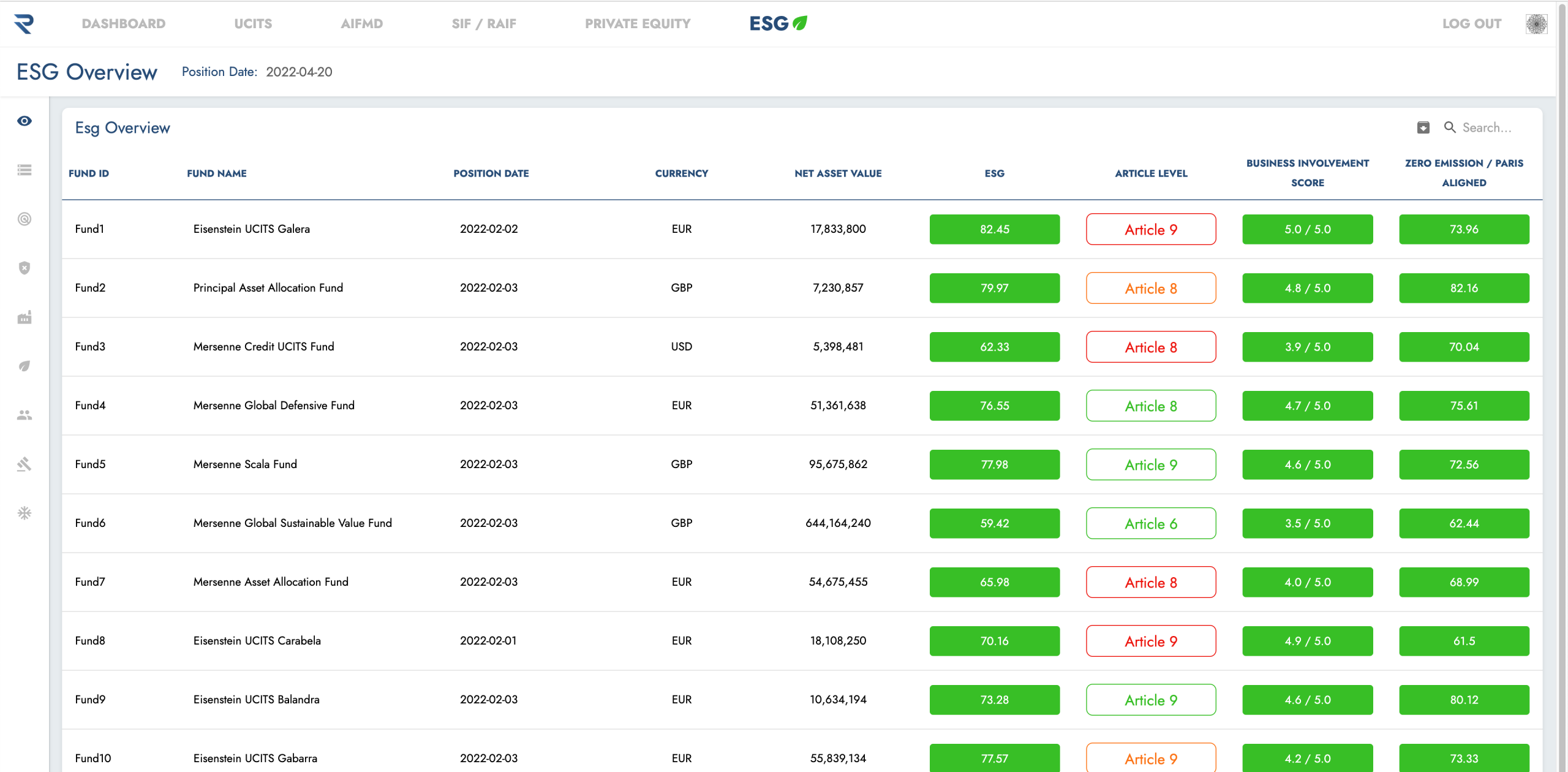

ESG Compliance Made Simple

The RiskSystem ESG functionality integrates a comprehensive database with RiskSystem’s risk functionality. This can be used to monitor the article status (6/8/9) and provides detailed reporting such as Principle Adverse Impact reporting, European ESG Template and SFDR/Taxonomy.

Why RiskSystem

RiskSystem is trusted by our clients to provide detailed, accurate and timely risk reporting

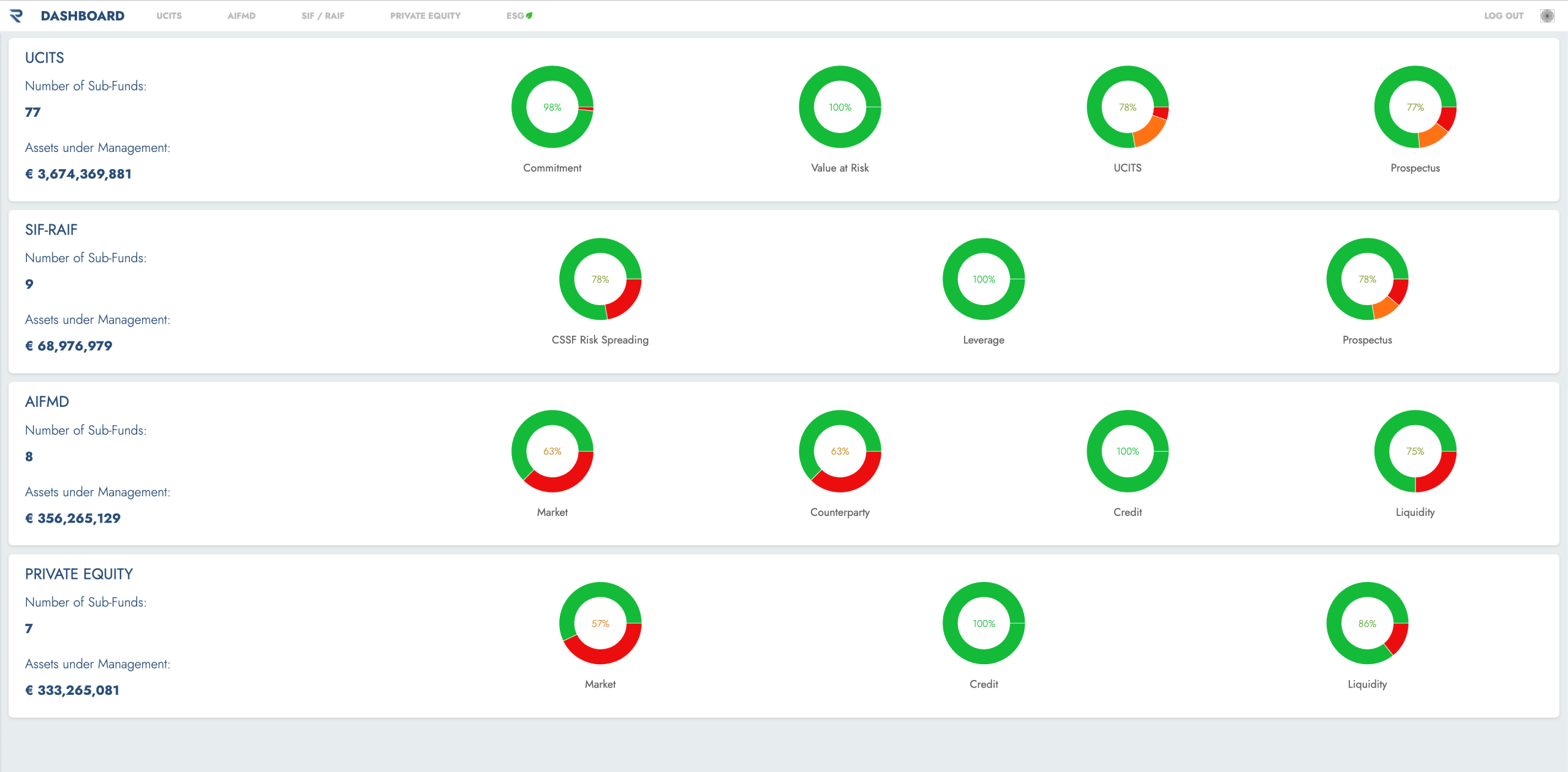

Integrated

Any number of sub-funds can be fully integrated into a single portal allowing easy identification of problems or potential issues.

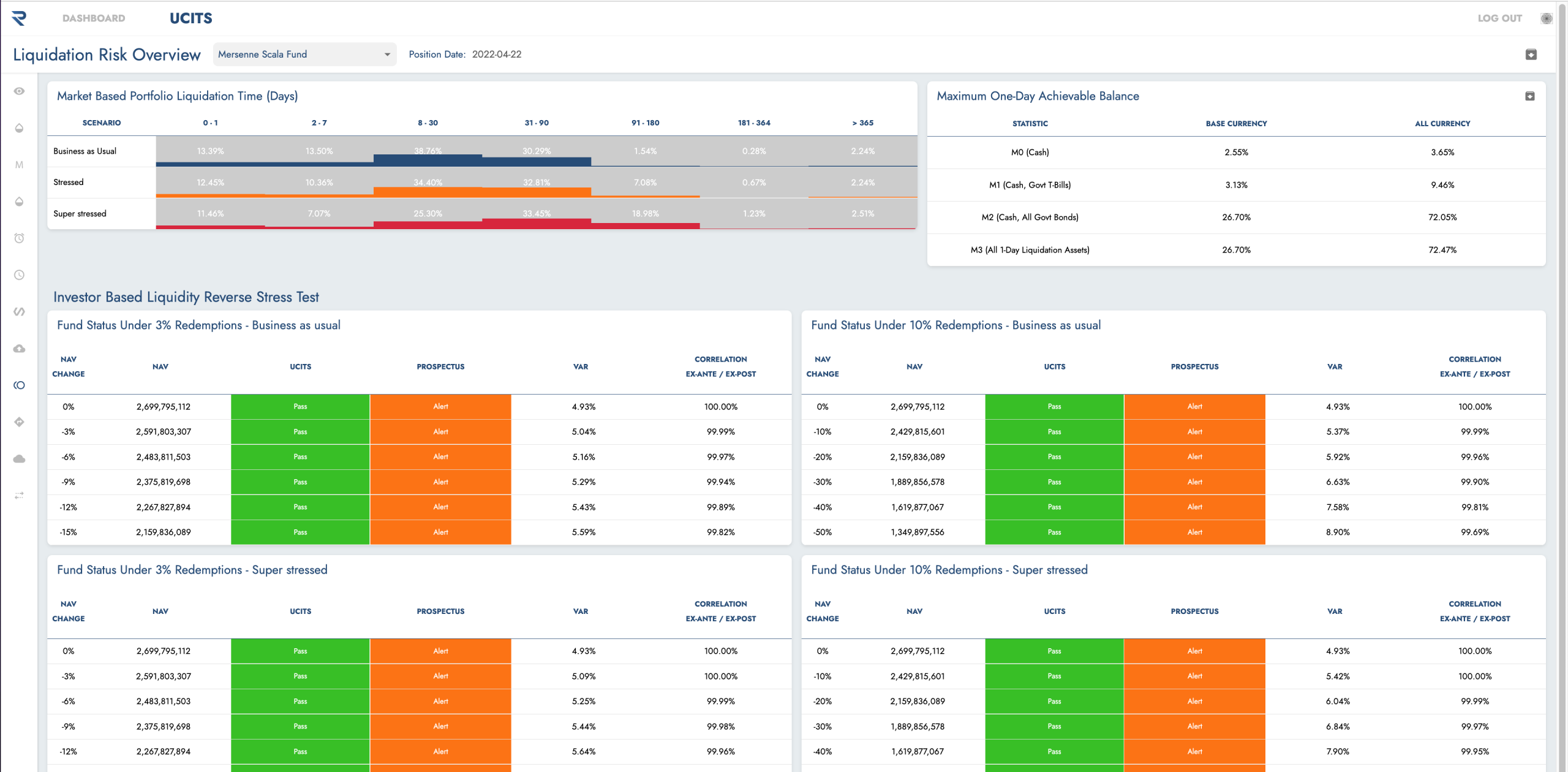

Comprehensive

RiskSystem covers all asset classes and risk types from derivative VaR to Liquidity Reverse Stress Tests and everything in-between.

Flexible

RiskSystem’s flexible functionality means that bespoke risk analysis tools and reports can be implemented in days rather than months.

Testimonials

What our clients say about us

We have been using RiskSystem for our data analysis and reporting for several years. RiskSystem is a combination of skilled analysts, programmers, and a highly experienced management team. They provide a robust system, high degree of flexibility and knowledge of the latest developments in the industry. They are always readily available to meet our needs. We are very pleased with both the team and the system as a whole.

David Mc Glynn

Chief Operating Officer

We are very pleased to have chosen Risksystem since nearly three years now for our risk analysis and reporting as well as for the control of investment limits. A really user-friendly platform, pleasant to use and very intuitive, no need for a complicated user manual. And a team always ready to help quickly, to propose and develop solutions that meet our needs. We do not regret this choice, quite the contrary!

Walter Fontan

Risk Manager, Adepa Asset Management SA

RiskSystem have proven to be very reliable partners in covering risk and regulatory reporting requirements of complex portfolios across multiple regulators

Eddie Steele

Chief Operating Officer, Broad Reach LLP

As part of our overall strategy we wanted to find a business that understood our needs and could help us ensure we created an environment that allowed a fund manager to grow their business whilst maintaining a strong compliant ethos for the benefit of their investors. We found that in RiskSystem. They have helped us deliver exactly what the board have required and have helped our investment managers grow their businesses with risk management at the core of everything they do

Stuart Alexander

Director

RiskSystem has great flexibility in analysing complex portfolios and making sense of the many risk drivers of our fund. We have seen many risk systems that just produce thousands of risk figures… the real added value is to select the risk figures that best represent the risk of the actual portfolio and they can bring to bear their many years of risk management experience and expertise. The RiskSystem team has been invaluable in optimising risk and performance reporting given the specifics of our strategy.

Dennis Essrich

Portfolio Manager, CreditSuisse AG

We are using RiskSystem for our risk and data analyses and reporting, investment limits and additional risk-related monitoring at both Management Company and portfolio levels. The online platform and system, Raptor, is not just user-friendly and intuitive but also highly customisable to fit very specific needs, requests and purposes which is priceless. In addition to highly skilled, reactive and experienced analysts, programmers and management team, Risksytem develops and offers state-of-the art methodologies using some of the latest available technologies always incorporating latest developments in the industry. We can only recommend RiskSystem as your new partner for risk and data related services.

Arnaud Mikolajczyk

Risk Manager