Liquidity Risk Evolution

RiskSystem provides liquidity risk evolution oversight across multiple metrics which describe the current and historical liquidity risk of a fund.

This provides our clients with constant oversight on the developing trends regarding market liquidity with direct relation to their own funds.

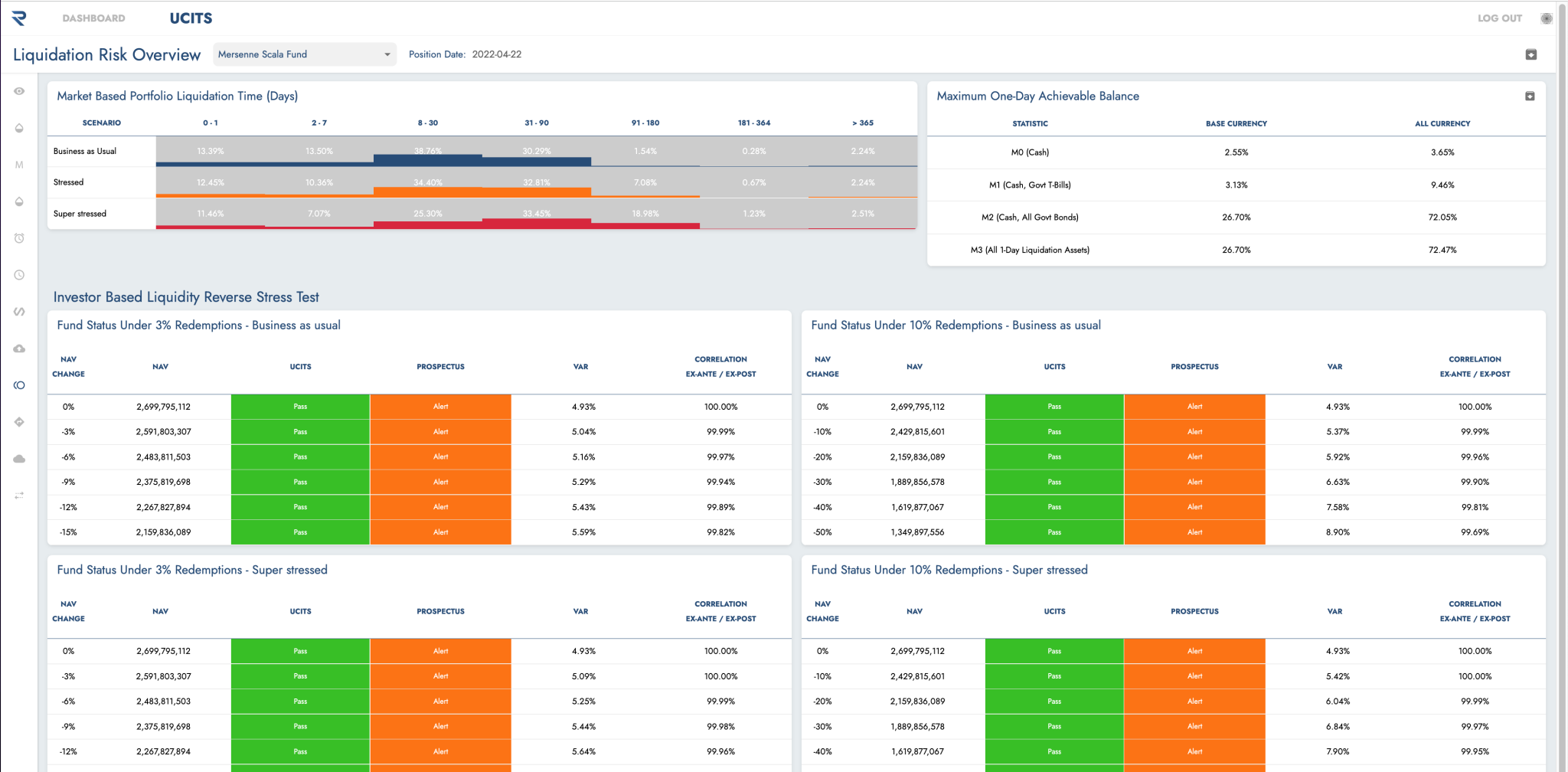

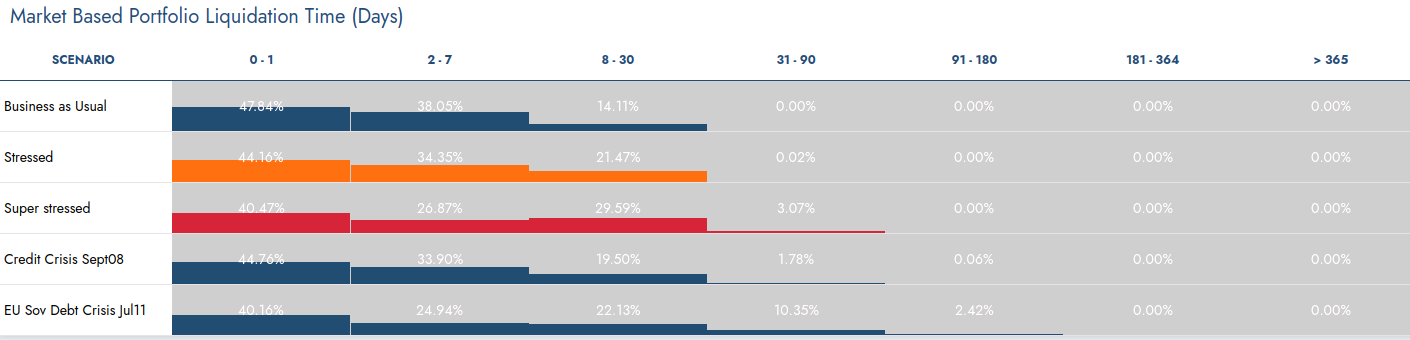

Liquidity Stress Testing

In a market of infinite variables, RiskSystem employs a liquidity solution that applies significant stresses to various factors to best estimate the liquidity risk of a fund.

Using both fixed and variable reverse stress testing approaches, RiskSystem can highlight the vulnerability and resilience of our client’s fund’s to potential liquidity shortages in the market under Business as Usual (BAU), Stressed, and Super-Stressed environments.

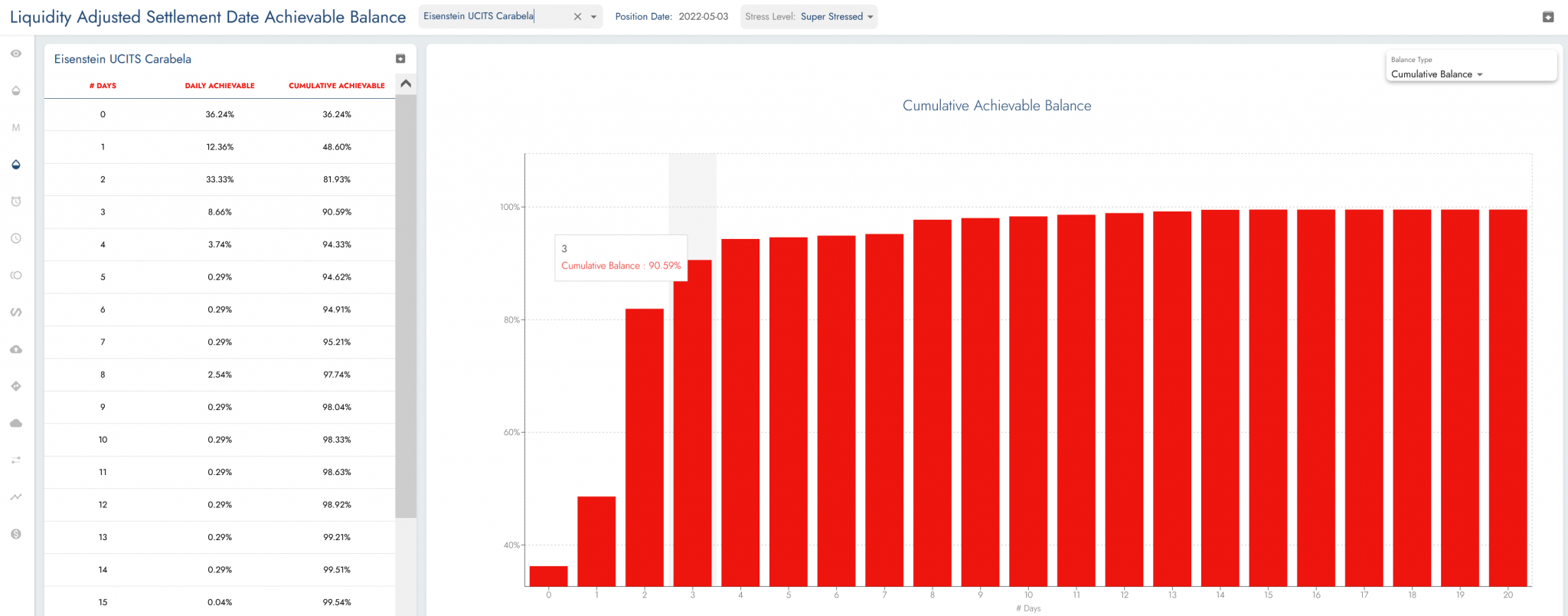

Redemption Coverage Ratio

Liability liquidity risk is a vital component of the overall liquidity risk of a fund.

To ensure that the fund is consistently positioned to meet potential redemptions, RiskSystem utilises in-house designed functionality known as:

- MOAB (Maximum One-day Available Balance)

- LASDAB (Liquidity Adjusted Settlement Date Available Balance)

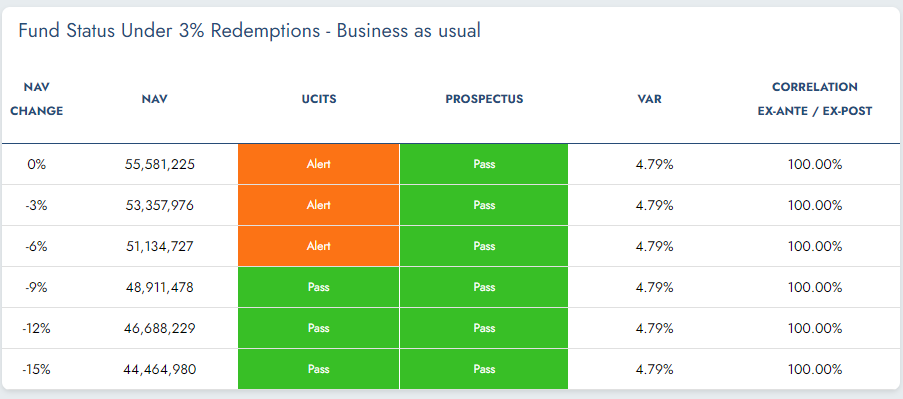

Liquidity Reverse Stress Testing

To ensure our clients are prepared for adverse market conditions and redemption scenarios, RiskSystem offers a range of historical and hypothetical Liquidity Reverse Stress Tests.

This functionality monitors our client’s portfolio’s capability of remaining compliant throughout periods of significant redemptions and liquidity shortages.

Key Features

RiskSystem offers many advantages over competing risk solutions

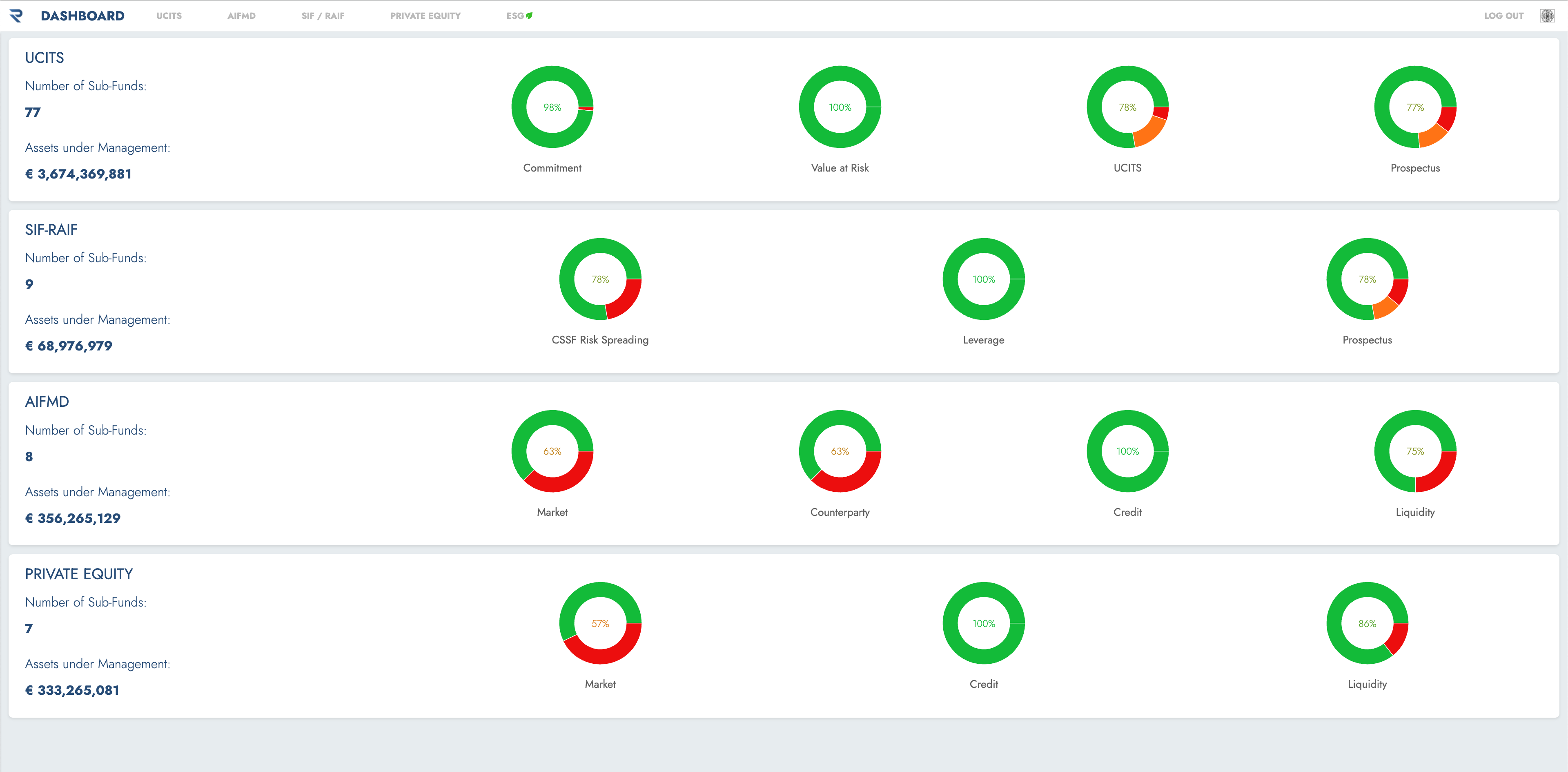

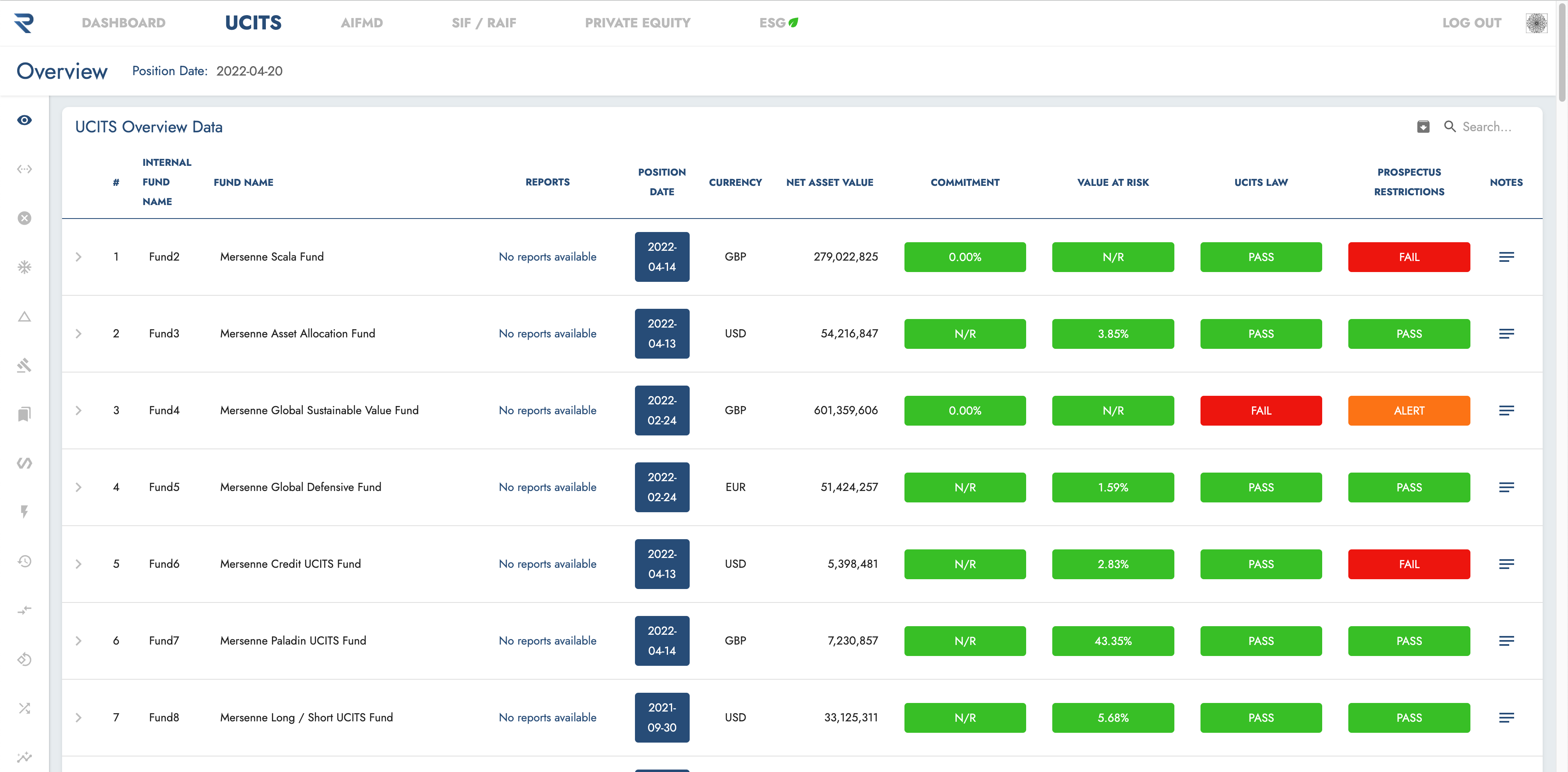

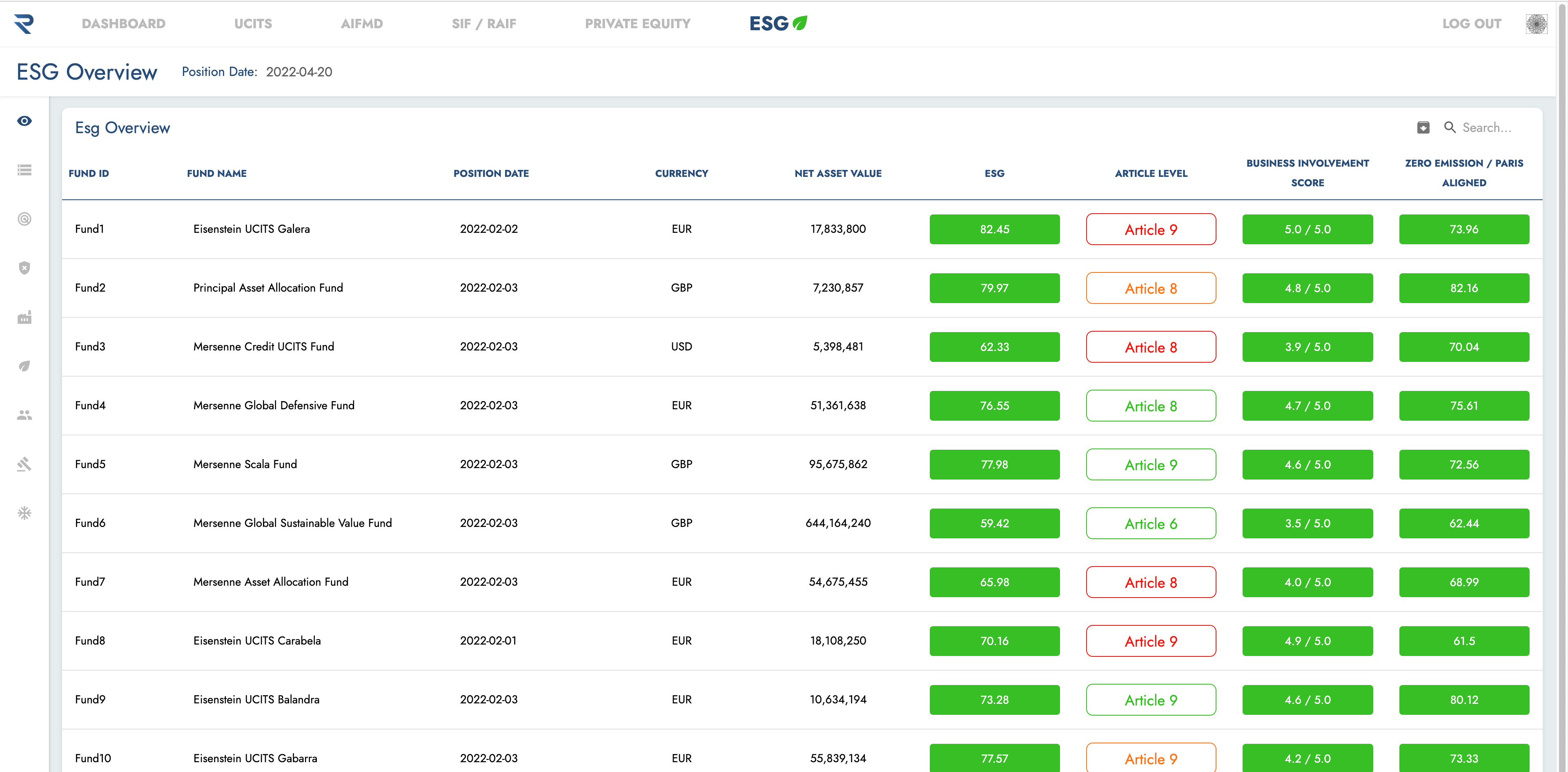

Integrated

The risks of any number of sub-funds are integrated into one portal.

Customisable

All functionality and reporting can be tailored to clients requirements.

Comprehensive

All instruments and fund types covered.

Scalable

Our internally developed functionality ensures rapid on-boarding of new funds removing any constraints on growth of funds under management.

Full Managed Service

Sourcing, cleansing, enriching and processing all data from any preferred source in any format is our responsibility.

Secure

All data and risk analytics are stored in a highly secure private cloud.