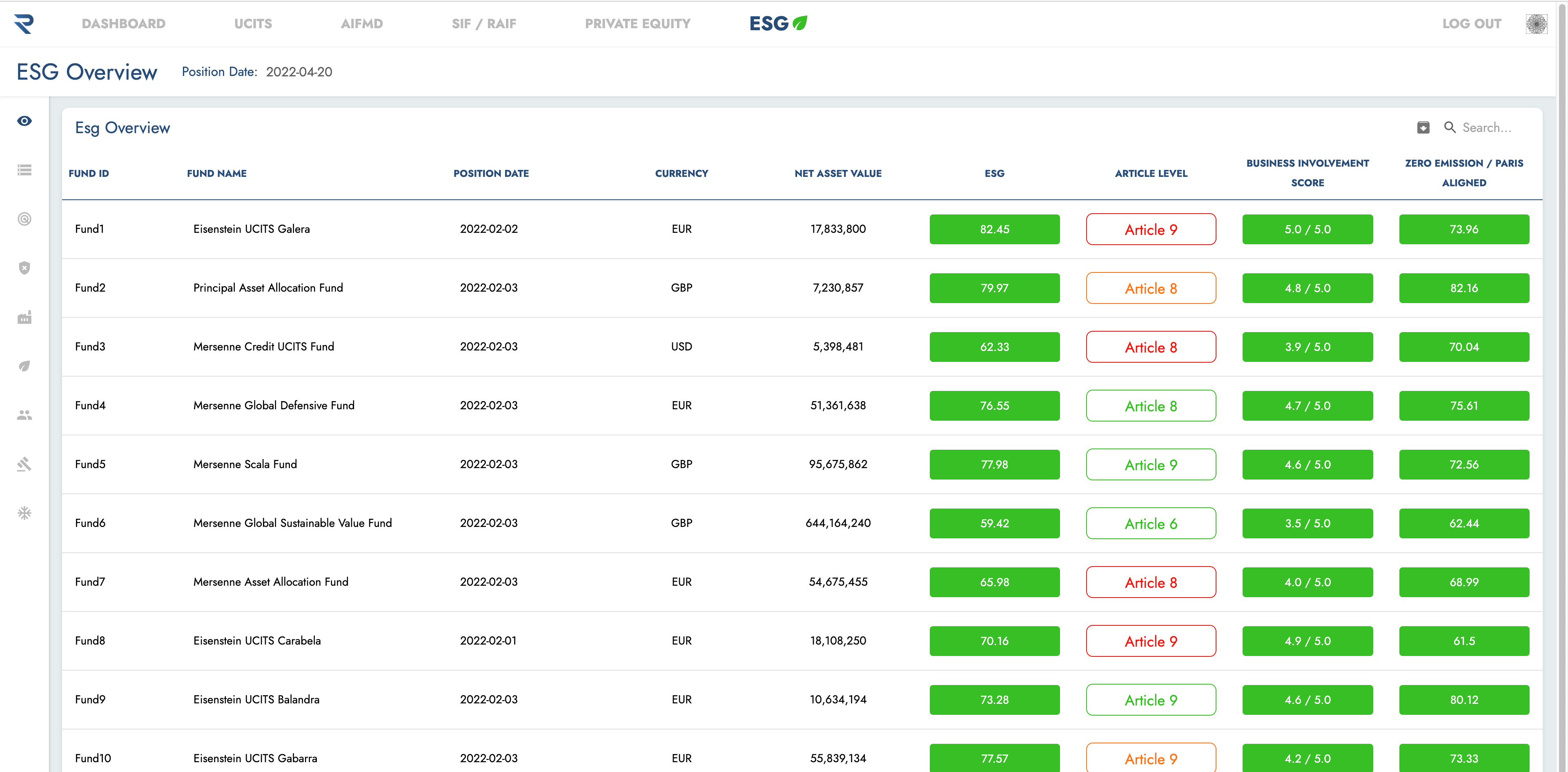

ESG Compliance Oversight

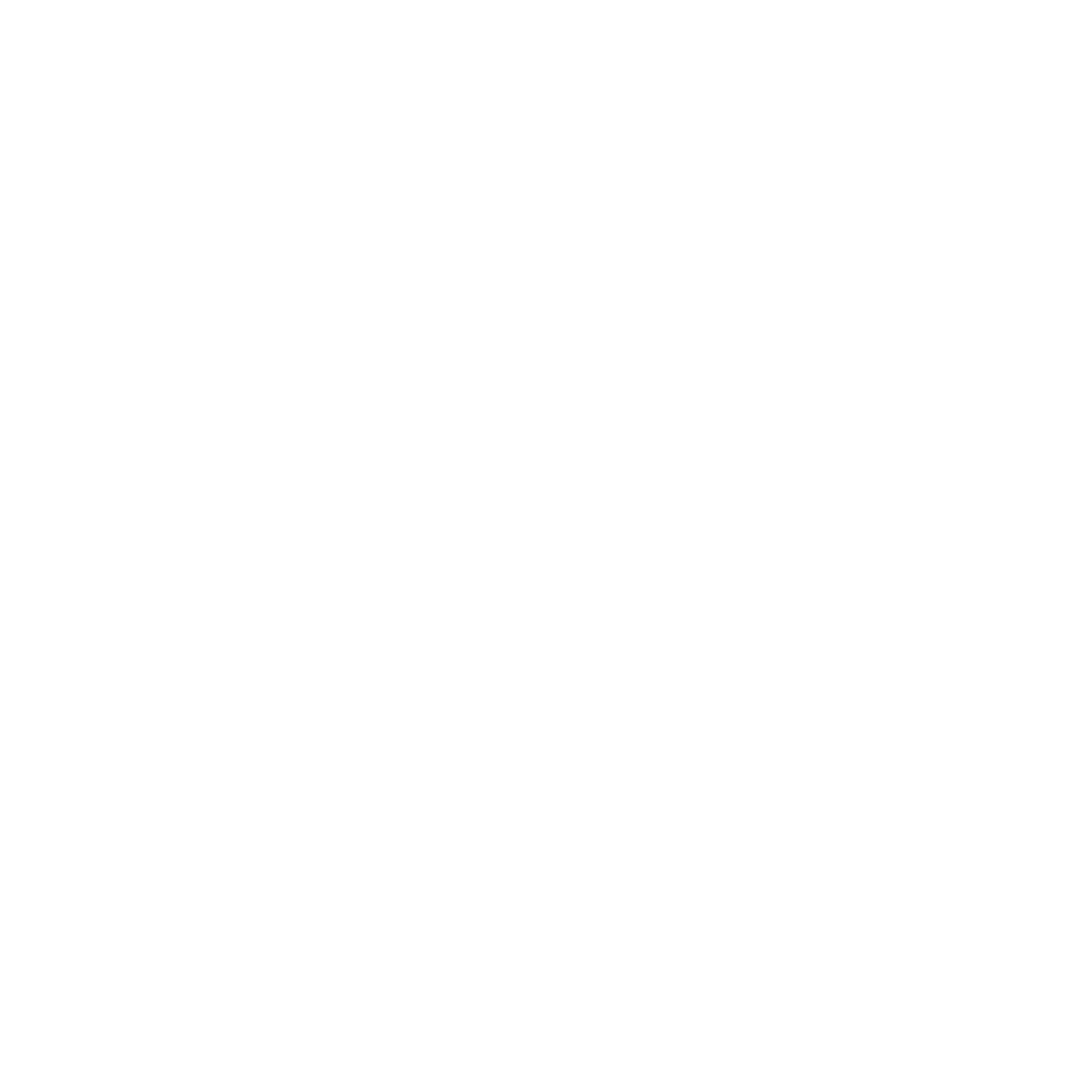

Monitoring your funds ESG compliance is simple with the RiskSystem integrated ESG monitoring solution. With over 40,000 companies covered and over 350 data points RiskSystem has one of the most comprehensive ESG solutions available.

Easily monitor the Principle of Adverse Impact on portfolios with reference to indicators such as carbon emissions, water emissions, biodiversity impacts, social violations, etc. Producing the Principle Adverse templates is a simple click of a button.

RiskSystem’s also offers a propitiatory Article scanner functionality which makes monitoring of compliance with SFDR trivial.

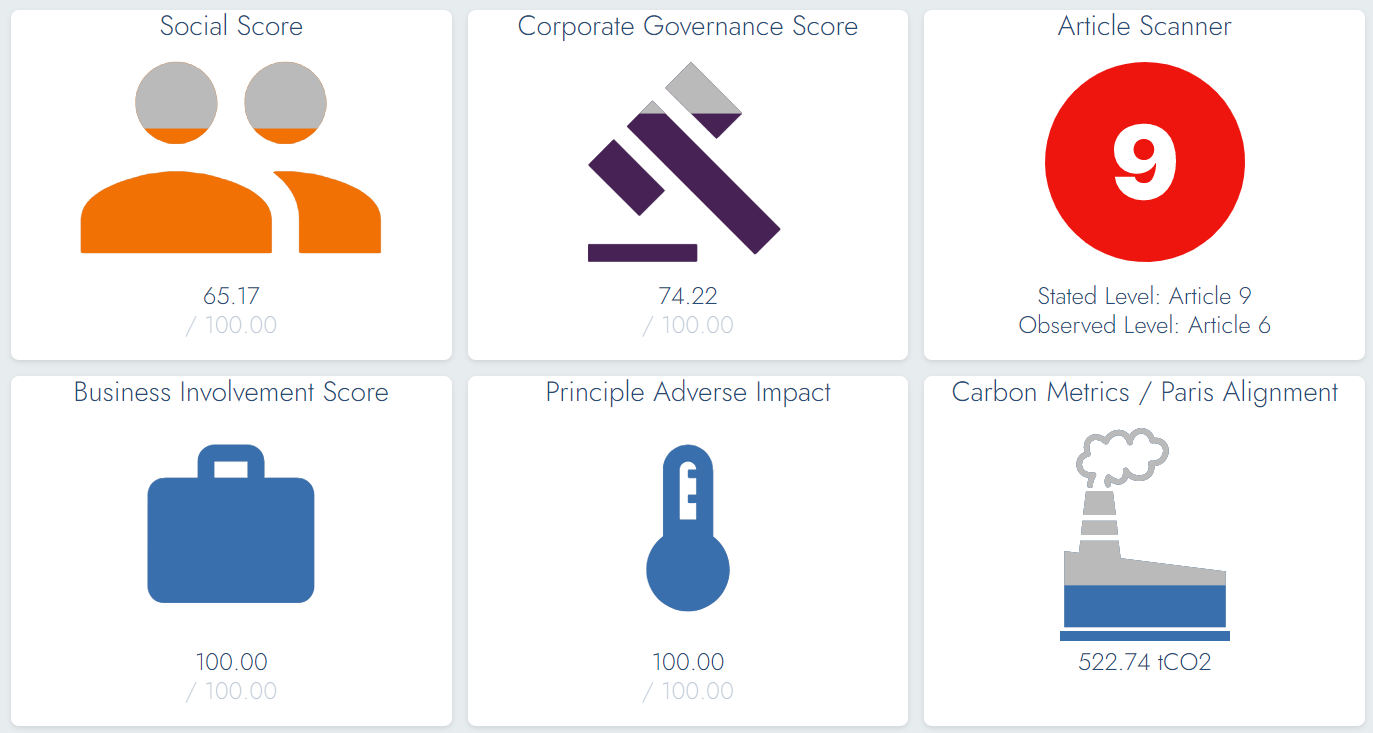

Environmental Analysis

RiskSystem facilitates easy monitoring of a portfolio’ carbon emissions among an array of environmentally focused metrics.

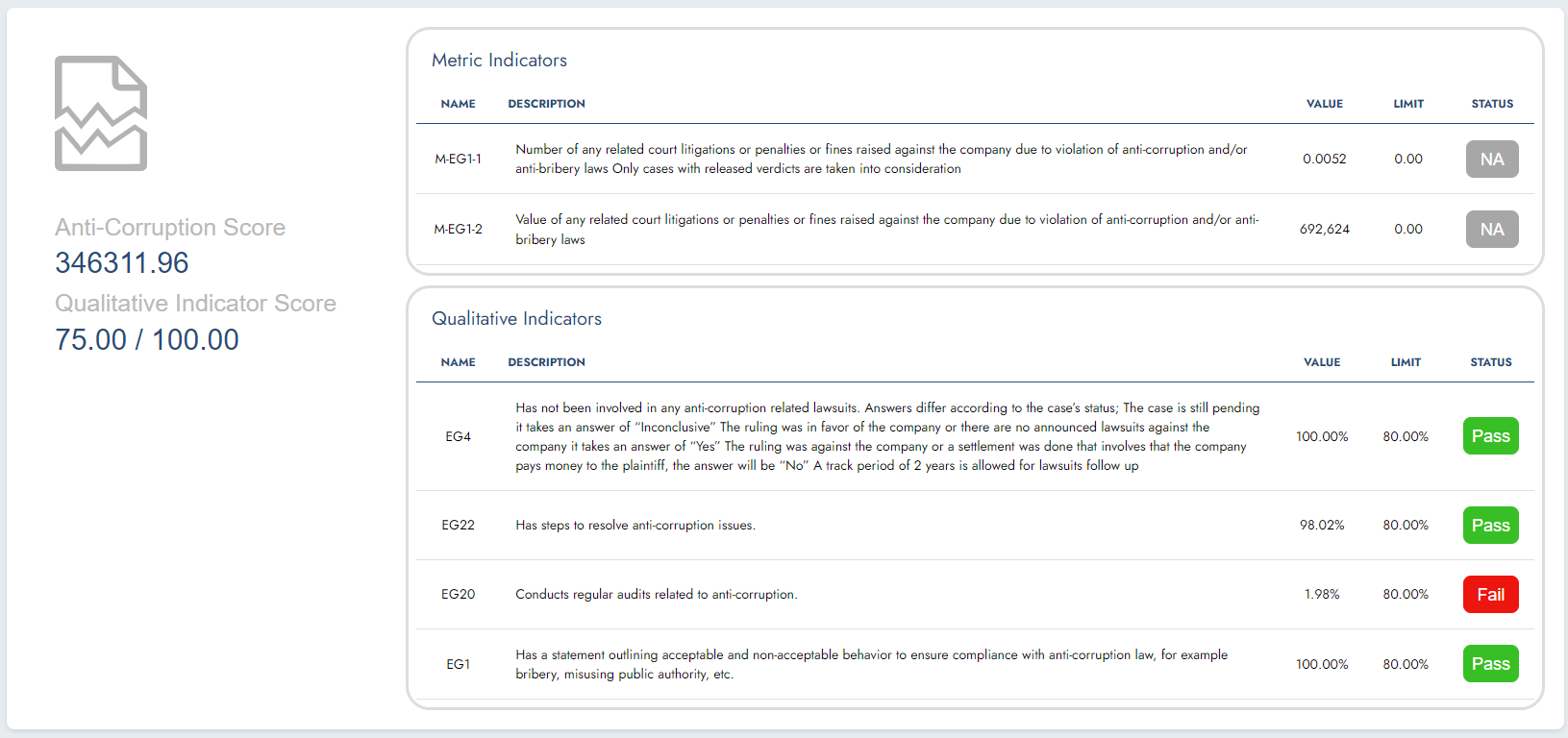

RiskSystem monitors environmental key performance indicators such as Air Emissions, Energy Management, Environmental Management, Habitat Protection, Waste Management and Water Management. Both qualitative and metric indicators are measured and monitored.

ESG Portfolio Optimization

With more complex ESG regulations coming in place, our engine is able to take a deeper dive into the quantitative aspect of ESG.

RiskSystem helps to optimize portfolio exposures to mitigate ESG regulatory risk, calculate key metrics such as ESG deltas, ESG VaR, etc. and brings the knowledge of traditional quantitative risk management into the world of ESG.

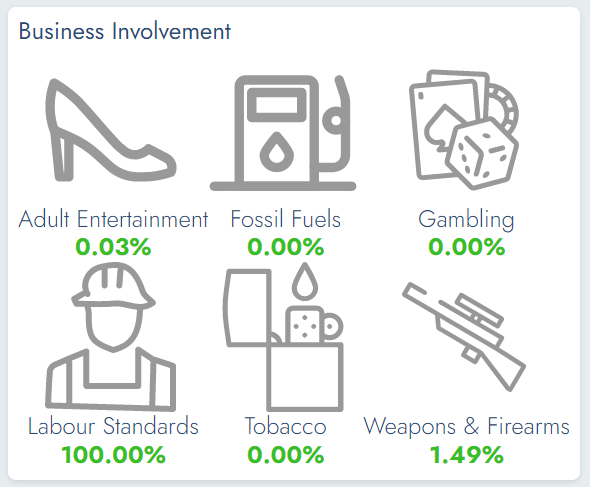

Business Involvement

Getting an understanding of invested company’s sensitive business practices is becoming a more crucial part of the ESG fund oversight.

RiskSystem provides comprehensive tools to scan the portfolio assets for particular involvements such as child labour, gambling, neglected labour standards, adult entertainment, etc.

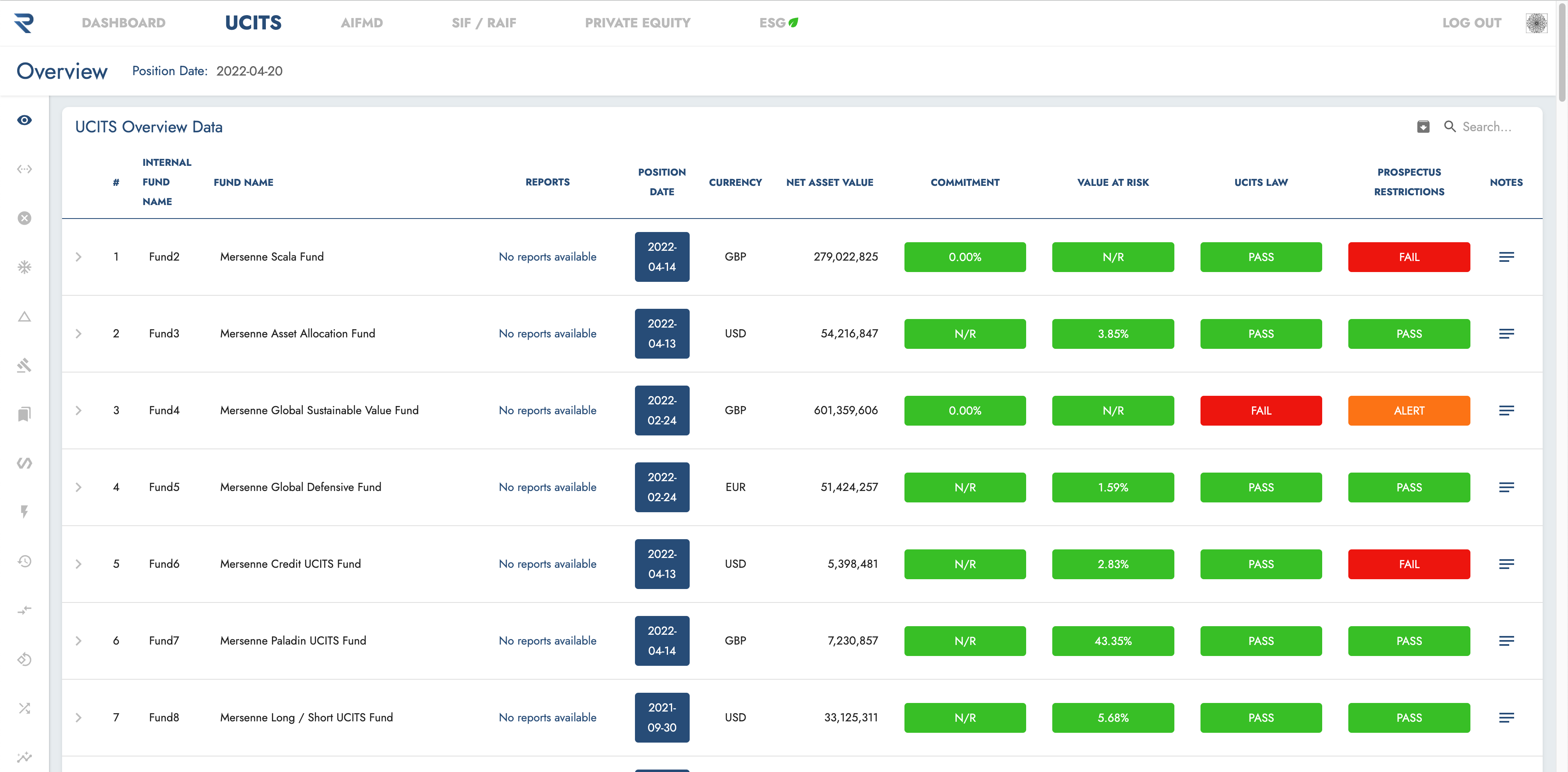

Exclusion Screening

To support our clients with compliance to their investment policies, RiskSystem is scanning and alerting fund managers regarding potential investments in assets which are excluded due to the funds environmental, social or governance related investment policies.

Key Features

RiskSystem offers many advantages over competing risk solutions

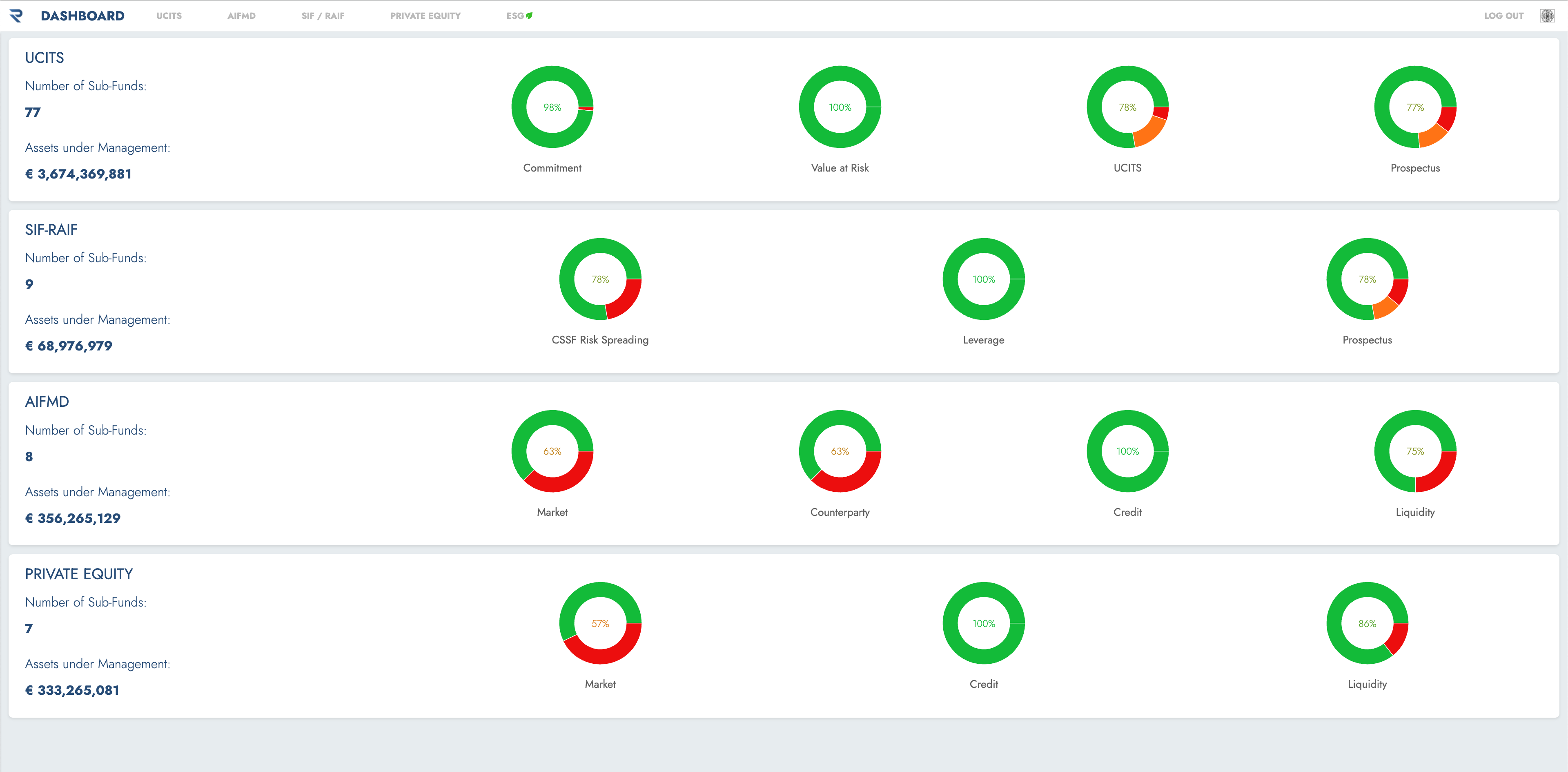

Integrated

The risks of any number of sub-funds are integrated into one portal.

Customisable

All functionality and reporting can be tailored to clients requirements.

Comprehensive

All instruments and fund types covered.

Scalable

Our internally developed functionality ensures rapid on-boarding of new funds removing any constraints on growth of funds under management.

Full Managed Service

Sourcing, cleansing, enriching and processing all data from any preferred source in any format is our responsibility.

Secure

All data and risk analytics are stored in a highly secure private cloud.

Social Analysis

Under the social pillar we analyse indicators such as Human Capital, Consumer Rights, Community Development, Supply Chain Management and Animal Welfare.

Basic human rights and ensuring proper working conditions are considered essential for employees’ satisfaction, retention of staff and the ultimate success of every company. RiskSystem can also screen for adherence to international norms such as UDHR, ILO etc.