Cybersecurity

To provide maximum data protection and operational resilience, RiskSystem is fully cloud-based and deployed on a world-wide server cluster, which protects the system and our clients from downtimes and gives RiskSystem the flexibility to react quickly and continue operations even under stressed situations such as the Covid pandemic in 2020.

Machine Learning

RiskSystem uses a variety of innovative machine learning techniques in order to better employ noisy financial data and to extract usable risk information from noisy financial datasets. At the asset level, anomaly detection algorithms such as Isolated Forests allow RiskSystem to extract segregated asset liquidation time data from extremely large datasets and fuzzy logic and Natural Language Processing is used to identify sanctioned companies within portfolios. Furthermore, at the portfolio level, aggregate financial data is being analysed within a deep learning framework to identify macro and micro-stress events within markets, to enhance the overall risk monitoring framework.

Bespoke Reporting

Our strength is in customizability and flexibility in delivering oversight and solutions for every risk management process – whether that be our new Sanctions Monitor reporting, or client-specific new asset notifier, we can construct any report you require for your risk management oversight.

Anomaly Detection

RiskSystem’s Anomaly Detection engine monitors all position prices and spreads to detect material differences in price movements, stale prices, missing prices and gaps in data, day to day, so that the user can detect irregularities as they appear and act accordingly, 24/7, 365 days a year.

3rd Party Integration

We take your data whichever way you want to supply it – xls,csv, FTP etc. RiskSystem works with a wide range of fund administrators in the data collection process and will independently integrate your style of filing into our RiskSystem engine.

Restricted Asset Scanner

RiskSystem can monitor fund assets against US,UK and European Union sanction lists on a daily basis if required.

Key Features

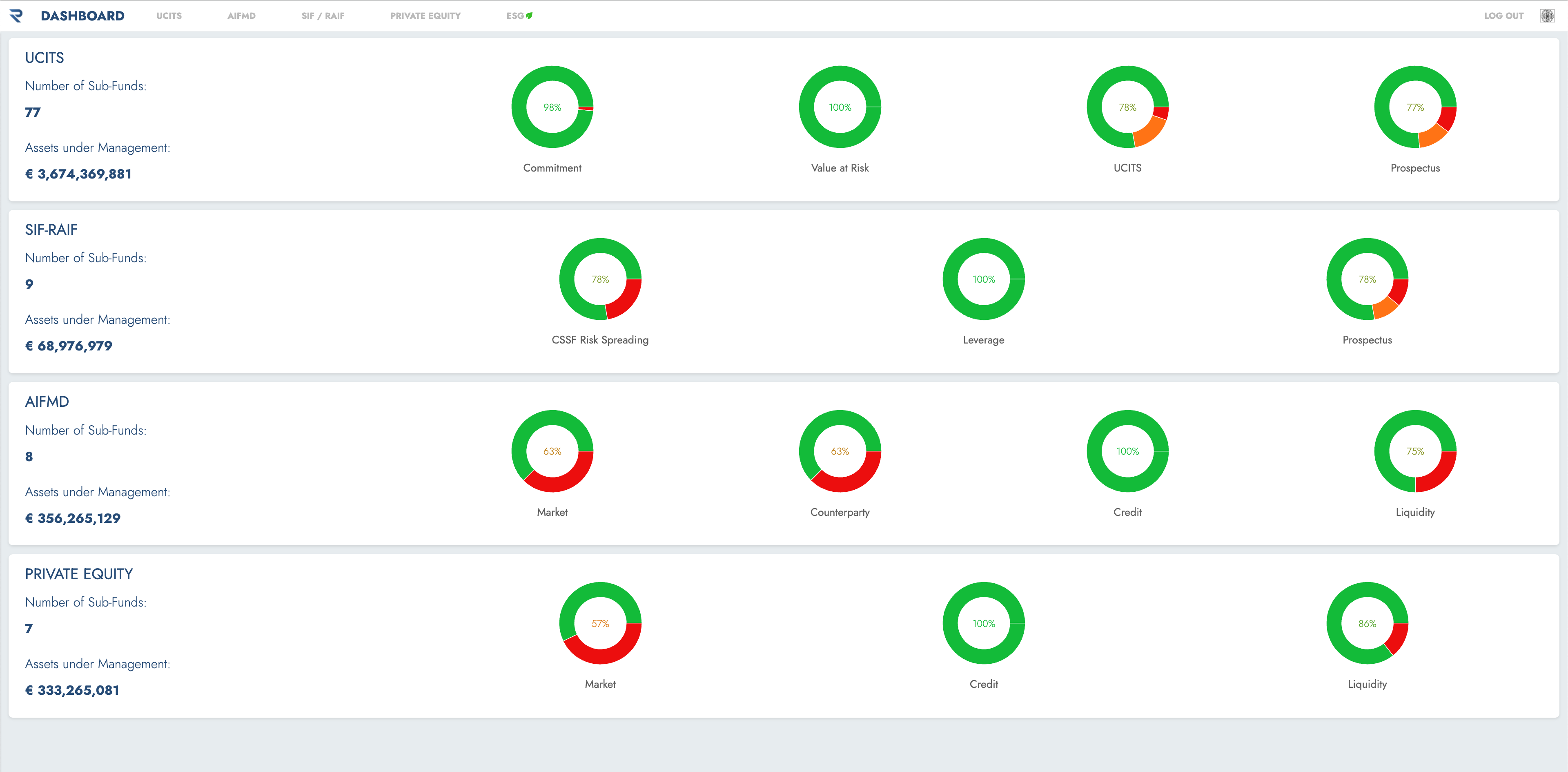

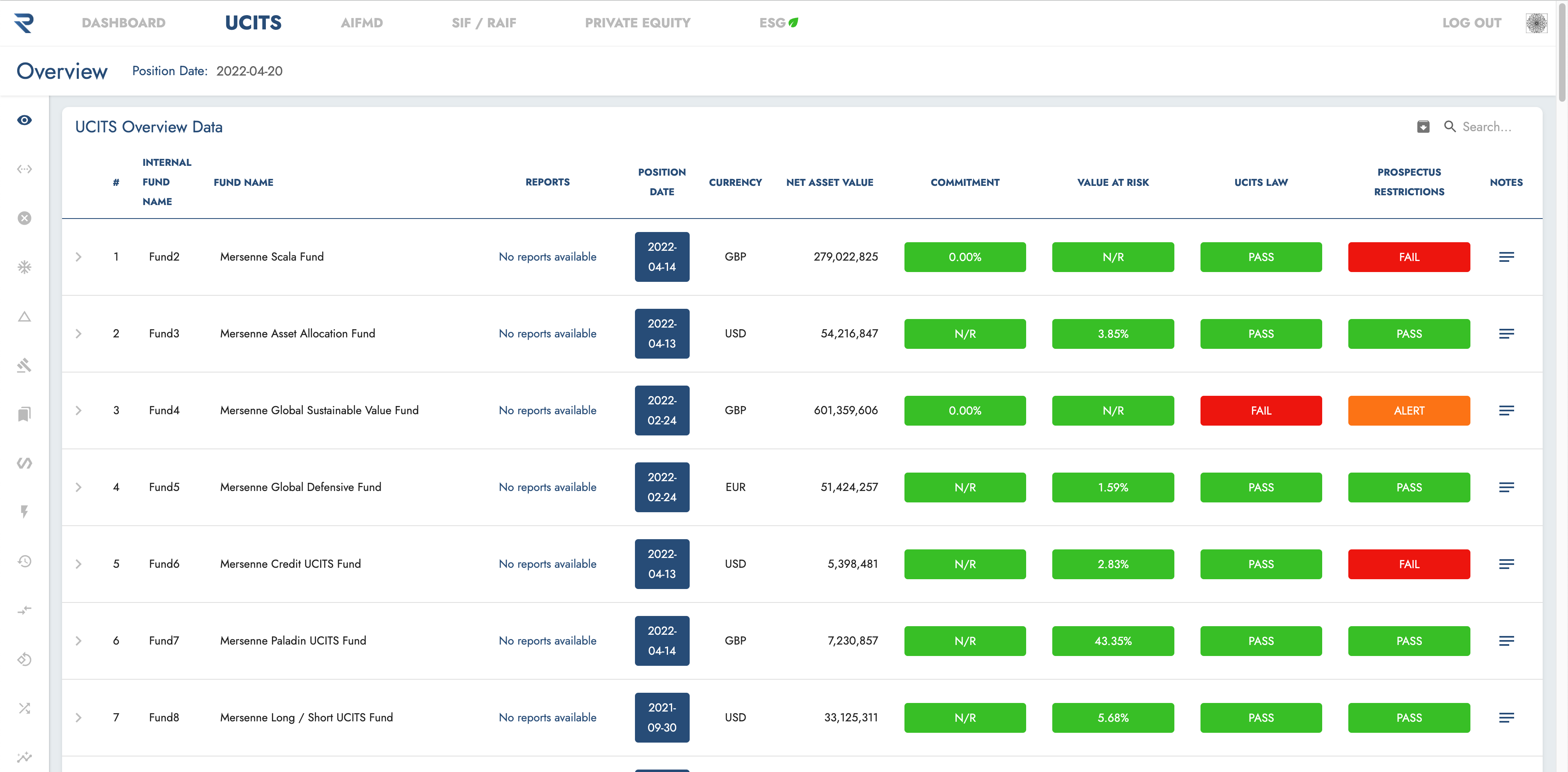

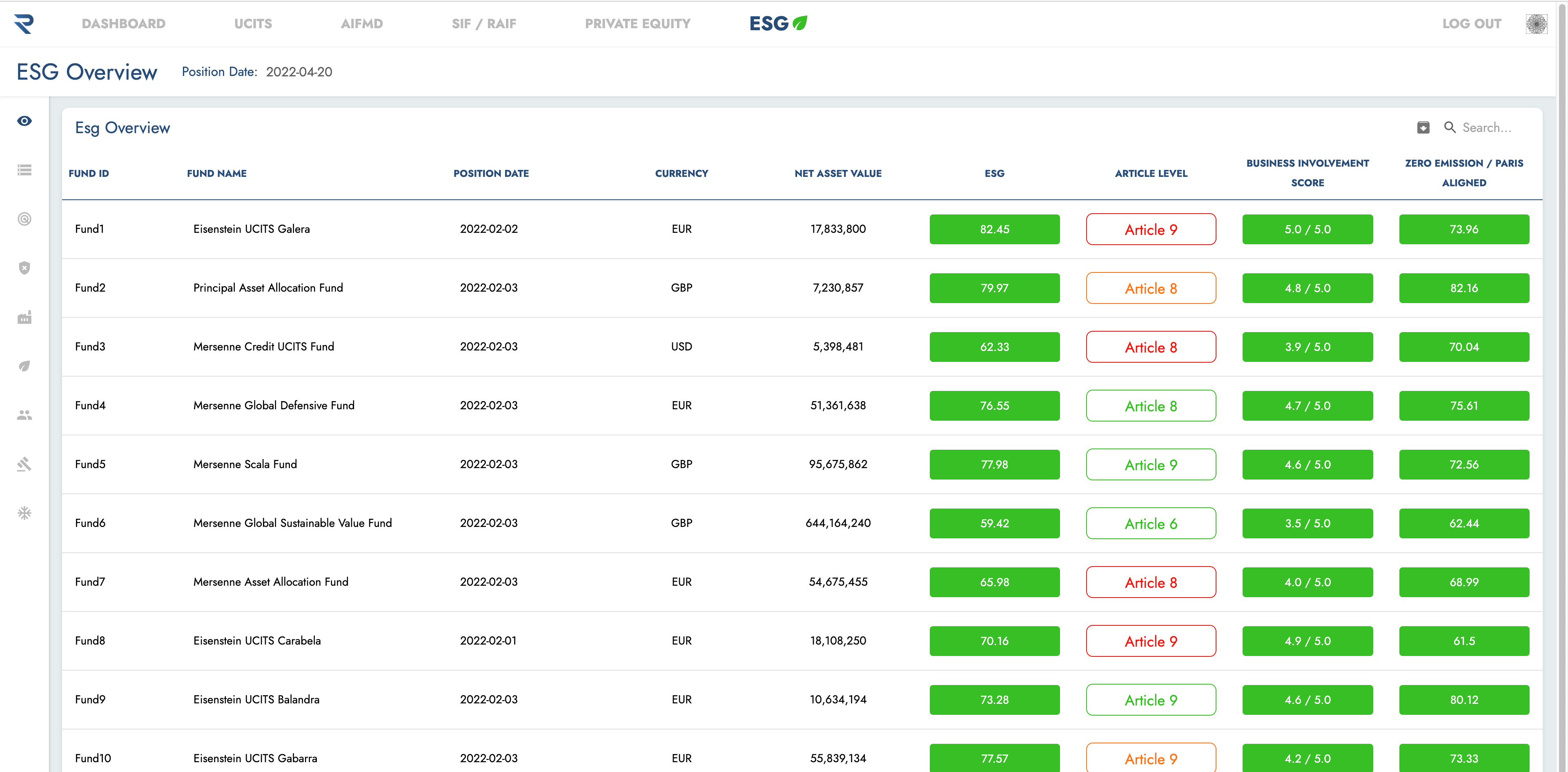

RiskSystem offers many advantages over competing risk solutions

Integrated

The risks of any number of sub-funds are integrated into one portal.

Customisable

All functionality and reporting can be tailored to clients requirements.

Comprehensive

All instruments and fund types covered.

Scalable

Our internally developed functionality ensures rapid on-boarding of new funds removing any constraints on growth of funds under management.

Full Managed Service

Sourcing, cleansing, enriching and processing all data from any preferred source in any format is our responsibility.

Secure

All data and risk analytics are stored in a highly secure private cloud.