Background

As of January 1, 2018 the Packaged Retail Investment and Insurance-based Products (PRIIPs) regulations came into force. PRIIPs extends the consumer protection standards introduced by MiFID II to insurance-based investment products. The objective of the regulations is to increase the efficiency of financial markets and to make consumers more financially aware of product they are purchasing and to facilitate better comparisons across product lines. Time will tell whether these lofty ambitions will be realised but the start is not terribly promising given how many asset managers seem confused by (or downright disparaging of) these new regulations, never mind potential inability of the underlying consumers of such products to understand much of the jargon.

So what is PRIIPs all about?

Let us begin the journey with describing what a PRIIP actually is. The FCA defines a PRIIP as “an investment where, regardless of its legal form, the amount repayable to the retail investor is subject to fluctuations because of exposure to reference values or to the performance of one or more assets that are not directly purchased by the retail investor; or an insurance-based investment product which offers a maturity or surrender value that is wholly or partially exposed, directly or indirectly, to market fluctuations.” Essentially these include retail investment products (marketed in the European Union), including insurance policies, and other “packaged” investment products sold by banks, insurance companies or other financial institutions.

Providers of PRIIPS are obliged to produce a Key Information Document (KID) for each PRIIP to retail investors resident in the EEA that are considering purchasing such products. The guidelines for producing the KID Commission are in the Delegated Regulation (EU) 2017/653 of 8 March 2017 supplementing Regulation (EU) No 1286/2014 of the European Parliament and of the Council1. The Regulations apply to persons who manufacture PRIIPs and/or advise on or sell PRIIPs, and the KID must be published on the provider’s website. Firms advising or selling a PRIIP to retail clients must provide the investor with a KID in good time before the transaction is concluded.

The FCA has a long list of who they expect PRIIPs to apply to including retail investment product providers, life companies, discretionary investment management firms, firms providing services in relation to insurance-based investments, fund managers, stockbrokers and other firms that provide advice to retail clients on funds, structured products and derivatives, financial advisers and firms operating retail distribution platforms. It is important to stress that the regulations only apply if the PRIIP is made available to retail investors. Furthermore the FCA notes that “identifying whether a particular product is a PRIIP may not be straightforward as the concept of ‘exposure to reference values’ is wide. In some cases, you will need to consider the specific terms of a product before determining whether or not it is a PRIIP.” There is a helpful if not exhaustive list of what may constitute a PRIIP (or not) on the FCA website2. Note that UCITS, whilst falling under the definition of PRIIPs, have a carve-out until 31 December 20193.

Many operating in the UCITS world will be familiar with the concept of the Key Investor Information Document (KIID) – a pre-contractual (two page maximum) summary document that has a very restrictive and proscribed format that must be followed. The PRIIPS KID is somewhat similar in that it has to be a stand-alone, standardised document but it may be up to a maximum of 3 pages in length. In line with the PRIIPs Regulatory Technical Standards (RTS) the KID details risks, performance scenarios, costs and other pre-contractual information in a standardised way. Much of the KID is comprised of static data (name of manufacturer, insurance benefits, how to complain etc.) but the rest is dynamic data that needs to be monitored and updated periodically (e.g. costs, risk indicators, performance scenarios).

Dynamic Data

Again similar to the UCITS Synthetic Risk and Reward Indicator (SRRI), the KID for PRIIPs will also contain a risk indicator, the Summary Risk Indicator (SRI)4. The SRI indicator is a combination of a Market Risk Measure (MRM) and a Credit Risk Measure (CRM). How the MRM is calculated depends on which category the PRIIP fits into. In summary the four categories (defined by pay-out structure) are:

Category 1 -> pre-defined classification (investor can lose more than they invest)

Category 2 -> constant multiple products (linear products, no caps/floors/collars etc.)

Category 3 -> non-linear products

Category 4 -> (partly) dependent on factors not observable in the market (eg With Profits Products).

The MRM is classified (into seven classes) and then derived through Cornish-Fischer or Monte Carlo Value-at-Risk using the history of observed returns of the PRIIP where available (or a proxy if not).

As an example for a Category 2 MRM is calculated using the following Cornish-fisher expansion:

VaR = sd√N * (-1.96 + 0.474 * μ1 / √N – 0.0687 * μ2 / N + 0.146 * µ1 2 / N) – 0.5 sd2N

[sd = Standard deviation]

Next the Var-Equivalent Volatility (VEV) is calculated using

{√(3.842 – 2* VaR) – 1.9 6} / √T

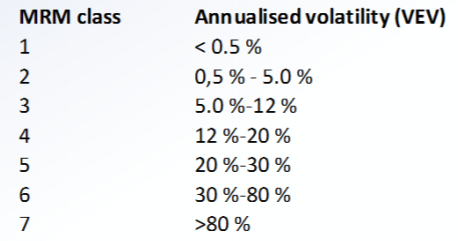

Finally the MRM class is determined by bucketing the VEV according to the table in figure 1 below.

Figure 15

Following the above the CRM may need to be calculated (for certain categories) whereby the credit risk of the PRIIPs is assessed on the entity providing payment (on a ‘look through’ basis to the underlying provider). If a third party is providing a guarantee its credit risk is assessed. The credit rating is assessed using credit rating agencies but mapped to six credit classes.

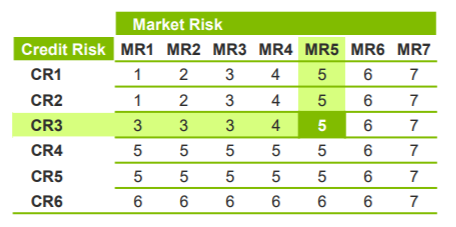

Finally once the CRM and MRM have been established the SRI is determined using the following table.

Figure 26

(By the way it is actually a lot more complicated than this – there are more decision trees than there is space to elucidate in this article).

Costs

If the above seems far from straightforward the disclosure requirements around costs are, in the words of Churchill, “a riddle, wrapped in a mystery, inside an enigma”. At the outset it has to be emphasised that the level of transparency around cost disclosures required under PRIIPs is substantially greater than that applicable to UCITS KIIDs. The PRIIPs calculation methodology must capture all costs and charges (ex-ante and ex-post) incurred by a PRIIP, including one off costs (e.g. entry and exit costs), ongoing costs (e.g., transaction costs incurred when trading) and incidental costs (e.g., performance fees). In the case of a new asset manager launching its first fund the asset manager should make a “reasonable”7 estimate of the expected costs and charges. Another quite controversial aspect of PRIIPS is the calculation of transaction costs which must be calculated according to a prescribed methodology in Annex VI of the PRIIPs RTS8.

Performance Scenarios

The KID also needs to display the future expected performance, i.e., average return per year after costs showing the range of possible returns in four scenarios:

(a) a stressed scenario;

(b) an unfavourable scenario;

(c) a moderate scenario;

(d) a favourable scenario.

This is quite different from the UCITS SRRI which uses past performance to categorise the fund by volatility bucket.

Reduction in Yield

A Reduction in Yield (RIY) calculation is also required to be calculated and presented in a table in the KID. The RIY is based on the “moderate” performance scenario, using the same holding periods as in the performance scenarios thus it is an ex-ante forward looking indicator. In simple terms the RIY is meant to show the effect the total charges applied to a policy will have on its potential rate of growth and is intended to be an easy way to compare the cost of one policy with another. The RIY is the difference between two percentages: (1) The annual internal rate of return related to gross payments made by the investor and the estimated payments to the investor during the Recommended Holding Period (RHP) and (2) The annual internal rate of return for the respective cost-free scenario. The difference in the two is the RIY.

Frequency of calculation

The guidance is not especially clear with regard to how often the SRI must be monitored and hence KID must be updated. It appears that as new prices of the PRIIPs are published the SRI needs to be recalculated. If daily prices are available, the MRM class must be checked and recalculated on a daily basis, the same applies in respect to weekly or bi-monthly prices. Asset managers are recommended to update the KID when there is a change in the SRI or a “material” change to the performance scenarios. ESMA suggests “material” is a change of 5% and the KID must be published on the PRIIPs provider’s website 5 business days after revision.

Issues with KIDs

It’s hard to even know where to start critiquing the PRIIPS KID. Numerous commentators have highlighted the lack of regulatory alignment between PRIIPS, UCITS and MIFID II. With regards the performance scenarios the FCA makes the following point “We understand some firms are concerned that, for a minority of PRIIPs, the ‘performance scenario’ information required in the KID may appear too optimistic and so has the potential to mislead consumers. There may a number of reasons for this: the strong past performance of certain markets, the way the calculations in the RTS must be carried out, or calculation errors.” It is not clear this only applies to a “minority” of PRIIPs.

A few month ago FCA chief Andrew Bailey was quoted as saying:

‘I want to be clear that I am concerned about Priips, and I know I am not alone. It carries a risk that it is leading to literally accurate disclosure which is not providing useful context, and there is evidence that funds, for instance from the US, are withdrawing from Europe to avoid the burden. I have also heard concerns about performance projections. We all have to take this seriously.’

Even esteemed chairmen of investment trusts such as Jamie Cayzer-Colvin, chairman of the £670 million Henderson Smaller Companies investment trust, are wading in against PRIIPs suggesting the performance forecasts could be misleading and therefore are not ‘appropriate or helpful’. Cayzer-Colvin says:

‘Along with all investment companies, we are required by new regulations introduced at the start of the year to provide investors with specific past performance scenarios, the calculation of which is prescribed by the regulation and is derived from the recent past performance of the trust. However, we do not believe that this is an appropriate or helpful way to estimate future returns and for this reason the results shown in the new documents should not be used for this purpose.’

Some of the issues that have been raised as being potential problems are firstly around the performance scenarios. The recent strong performance of markets may mean the performance scenarios are overly optimistic. Secondly many managers are calculating costs inconsistently (some funds include stamp duty in the costs, others exclude finance costs or performance fees). There are also widely differing estimates of transaction costs.

Of the 158 respondent to Winterflood’s 2018 Annual Investment Companies Survey (who mostly included wealth managers, investment trust directors, institutional investors and IFAs) 58% said the regulation which came into force in early January was “complex”, “impractical” and “unnecessary”. In addition Winterflood stated there was a strong consensus that KIDs were “misleading”, unhelpful” and even “irrelevant”.

RiskSystem Solution

In conclusion it is clear that the PRIIPs regulations, like much of financial regulation, is not perfect but we, as an industry, have to deal with it somehow and get on with the job of managing money for someone somewhere (an objective which, with all the focus on regulation, is easy to forget at times). At RiskSystem we have built an automated workflow process that on an ongoing basis collects the required inputs from the relevant source, calculates the various metrics and outputs required (MRM, SRI, RIY, CRM etc) and automatically populates and produces a European PRIIPs Template (EPT) or other data exchange template, or if required a complete KID. We have inbuilt trigger alerts as part of our ongoing monitoring that flags when material changes occur and the KID needs to be changed.

Please contact us if we can be of assistance (info@risksystem.com).

_______________________________________

1 https://eur-lex.europa.eu/legal-content/EN/TXT/?qid=1516899203728&uri=CELEX:02017R0653-20170412

2 https://www.fca.org.uk/firms/priips-disclosure-key-information-documents

3 The exemption is detailed in the PRIIPs Regulation Article 32 and recital 35.

4 What is it about the EU and acronyms? We now have a KID, KIID, SRI and SRRI – not at all confusing….

5 https://ec.europa.eu/info/system/files/risk-section-kid-11072016_en.pdf

6https://www2.deloitte.com/content/dam/Deloitte/ie/Documents/FinancialServices/investmentmanagement/IE_2016_LinknLearn_PRIIPs.pdf

7 For an ESMA definition of “reasonable” refer to questions 14 & 15: https://www.esma.europa.eu/sites/default/files/library/esma35-43-349_mifid_ii_qas_on_investor_protection_topics.pdf

8 Life is too short to get into a detailed explanation of the “arrival price” or “implementation costs” but an interesting paper can be found at https://www.transtrend.com/documents/16/Transaction_costs_PRIIPS_JAN2018.84004f.pdf.