As regards SFDR and ESG one hears frequently about Principle Adverse Impact. This article will explain what this concept means and outlines the RiskSystem solution that can assist managers meeting their regulatory obligations.

The concept of Principle Adverse Impact (“PAI”) is concerned with financial market participants[1] (“FMPs”) informing investors as regards the consideration of “sustainability factors[2]” in the investment decision-making and advisory processes. Essentially it is the adverse impact of the FMP’s investment decisions on these factors as measured by a set of indicators (mandatory and optional); in other words FMPs must disclose whether they consider the negative externalities[3] of investments on the environment or society.

It can be noted that PAI differs from “sustainability risk[4]” in that PAI is concerned with how the actions of the FMP impacts on the sustainability factors, whereas sustainability risk is concerned with how the investment itself is impacted by an ESG event were it to happen. Regulators are clearly hoping that investors will steer their capital towards firms that have a positive impact on sustainability factors and away from those that negatively impact such factors.

Firms were obliged to start considering the principle adverse impact (PAI) of their investments from June 30, 2021. From July 1, 2022, they are expected to report the mandatory information from January 1 to December 31 each year. According to the latest RTS, this PAI Assessment is to be based on the average of four assessment calculations made on 31 March, 30 June, 30 September and 31 December during the relevant reference period. Under the RTS, the first reference period runs from 1 January 2022 – 31 December 2022, with publication of the outcome of the PAI Assessment during the reference period due by 30 June 2023.

The PAI regime applies to 1) entities under Article 4 SFDR and 2) Products under Article 7 SFDR. The RTS contain certain mandatory and optional indicators to be used to carry out the PAI Assessment. There are 18 Mandatory indicators (the 15th and 16th indicators are sovereign related, and the 17th and 18th are real estate specific), and 46 additional voluntary indicators. FMPs must complete all mandatory indicators and at least two voluntary indicators. The indicators cover a wide range of environmental and social metrics, including scope one, two, and three GHG emissions, biodiversity impacts and board gender diversity etc.

Where an FMP does not consider the adverse impacts of investment decisions on sustainability factors, it must publish (on its website) clear reasons for why it does not do so (Article 4, SFDR). There are also separate indicators for impacts from investments in investee companies, sovereigns (and supra-nationals) and real estate assets.

The data challenges generally with ESG are well known and will not be further discussed in this article. In fairness to the regulators they did acknowledge this “The ESAs are aware that it may not be straightforward to assess the adverse impact of an investment decision due to the lack of reported data on a particular indicator.” However over time the data will undoubtedly improve so for now it’s a case of doing the best one can. It is worth noting that the data requirements have increased substantially – actual hard qualitative data is required e.g. Scope 3 emissions, emissions to water ratio etc.

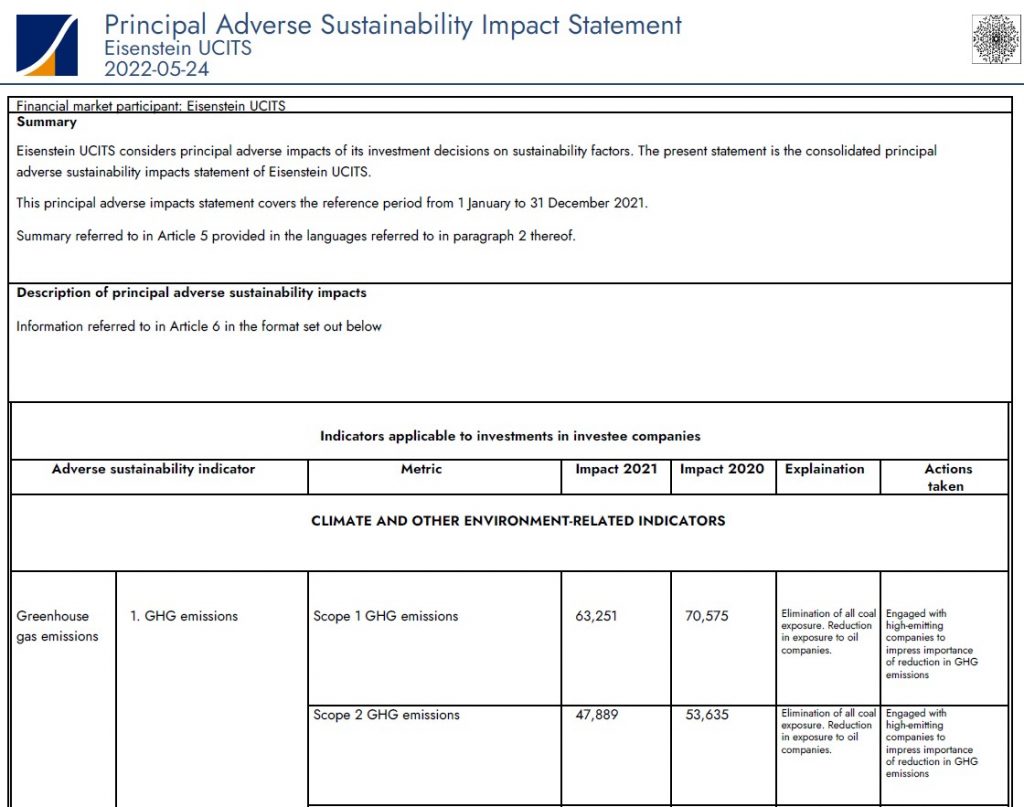

The RTS[5] are specific about presenting the data in an easy-to-read manner, easily accessible, free of charge etc. In addition the RTS provides a prescribed format or template for the PAI statement in Annex I[6] of the RTS.

Ultimately once all PAI indicators are no longer constrained by poor data availability it will be possible for investors to utilise them to make better informed decisions. Metrics can be compared across funds helping investors allocate towards “ESG friendly” funds reducing the risk of greenwashing.

RiskSystem is already collating the data necessary to complete the PAI templates. Indeed our functionality allows our clients to complete the templates at the touch of a button (see example below). Please get in touch if you would like to learn more.

Example of PAI report generated by RiskSystem

[1] Any firm creating investment products, or generally, an asset manager.

[2] Sustainability Factors defined under the SDFR as “environmental, social and employee matters, respect for human rights, anti-corruption and anti-bribery matters”.

[3] An externality or external cost is an indirect cost or benefit to an uninvolved third party that arises as an effect of another party’s activity.

[4] Refers to environmental, social or governance events, or conditions, such as climate change, which could cause a material negative impact on the value of an investment. (note however there is no regulatory definition for these events or conditions).

[5] https://www.esma.europa.eu/sites/default/files/library/jc_2021_03_joint_esas_final_report_on_rts_under_sfdr.pdf

[6] https://ec.europa.eu/finance/docs/level-2-measures/C_2022_1931_1_EN_annexe_acte_autonome_part1_v6.pdf